Trust Implementation & Wills

Call Today! (580) 678 - 9610

Q: What is a Trust?

A: A trust is a legal arrangement in which one party (the grantor or settlor) transfers assets to another party (the trustee) to hold and manage for the benefit of a third party (the beneficiary). Trusts are commonly used for estate planning, asset protection, and tax benefits.

Q: What is a Will?

A: A will (or last will and testament) is a legal document that outlines a person’s wishes regarding the distribution of their assets and the care of any minor children after their death. It ensures that their estate is handled according to their preferences rather than default state laws.

Estate Planning & Asset Protection

Call Today! (580) 678 - 9610

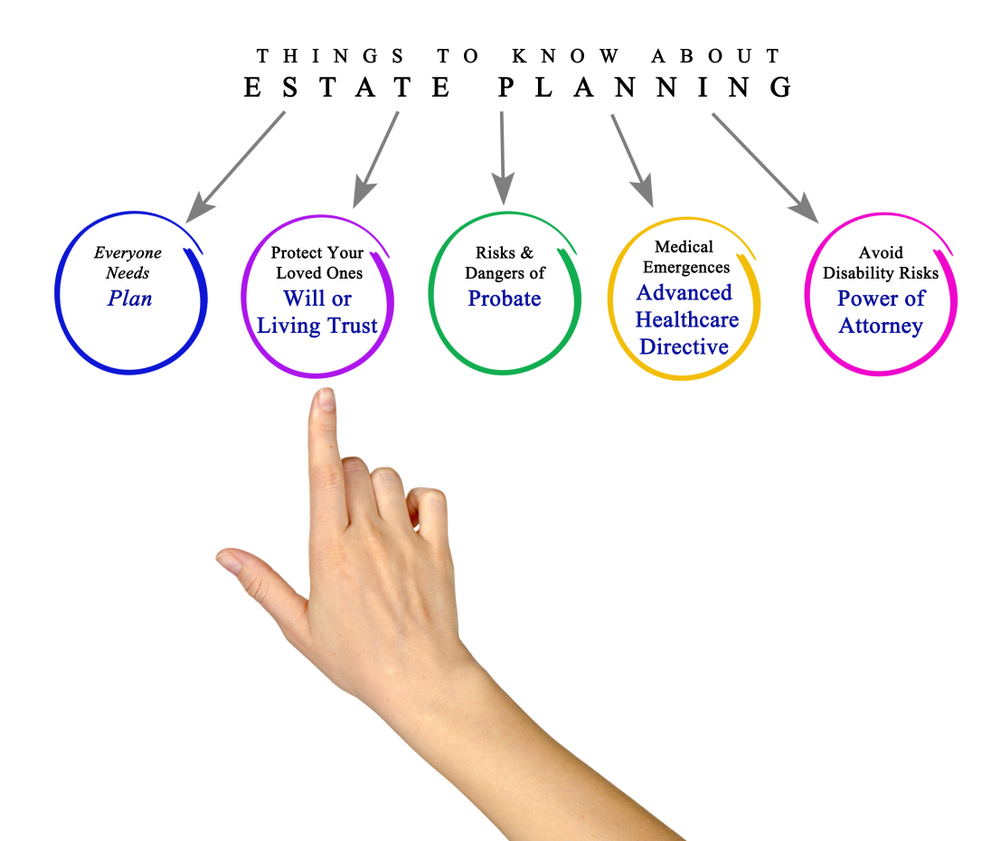

Q: What is Estate Planning?

A: Estate planning is the process of arranging how an individual or family trusts & will transfer their assets after death, while also considering the individual's needs before death. The goal of estate planning is to preserve the most wealth possible for the beneficiaries while also giving the individual flexibility.

Q: Why is Asset Protection Important?

A: An asset-protection plan employs legal strategies, put in place before a lawsuit or claim arises, that can deter a potential claimant or help prevent the seizure of your assets after a judgment.

Life Insurance

Q: What is Life Insurance?

A: Life insurance guarantees that a sum of money is paid either on the insured person's death or after a set amount of time. It is an agreement between an insurer and the policyholder that a designated beneficiary will receive the benefit in exchange for a premium.

Q: How does Life Insurance Help?

A: Life insurance products offer a contract between an insurer and the policy owner that guarantees payment of money to a named beneficiary when the insured person dies. It is like a promise to the owner in exchange for premiums paid by the policyholder. There are various types of policies designed to help fit the needs of clients on many different levels.

Annuities, IUL's

& Tax Free Retirment

Q: What is an Annuity?

A: An annuity is a fixed sum of money paid to someone each year, typically for the rest of their life, and also is defined as a form of insurance or investment entitling the investor to a series of annual sums or payments.

Q: What is an IUL?

A: Index Universal Life deals with regular universal life and indexed universal life policies. They are both flexible premium cash accumulating permanent life insurance policies if they are funded correctly.

Q: Why are annuities purchased?

A: Annuities in the U.S. are primarily purchased for two reasons. First, if someone wants to move a lump sum and they don't need it until retirement, they move this lump sum into an account that can never lose money. Over time, they turn 65 or 70. At that point, they can elect to get a monthly check guaranteed every single month, or until they die.

The second main way to use an annuity is to keep a bucket of money safe from market risk.

Q: Ways to build Tax-Free Retirement?

A: A couple of ways to start a Tax-Free Retirement Fund is to use an Annuity or an IUL. Please consult with your CPA for rules and regulations.